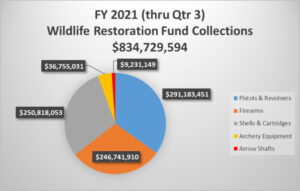

The latest data distributed by the Wildlife Management Institute shows excise taxes on guns and ammunition generated $834.7 million for conservation through the first three quarters of FY2021.

Established in 1937, the Pittman-Robertson Act placed an excise tax on guns, ammunition and archery equipment with the funding generated specifically earmarked for conservation work. Over those 84 years, P-R funding totals more than $14.1 billion. Excise tax deposits amount to roughly 50 percent of state wildlife agencies’ budgets.

Looking at the latest numbers, funding is up across the board in each collection category. Comparing the first three quarters of 2021 to 2020, pistols and firearms taxes are up 158 percent, firearms increased by 130 percent, shells and cartridges are up 113 percent and there are 89 and 81 percent increases respectively for arrow shafts and archery equipment.

State wildlife agencies also rely on dollars generated by hunting license and fees to carry out wildlife management, research, land protection, public access and other conservation work.

(Photo source: Nevada Department of Wildlife & graphic source: Wildlife Management)